Growing Mobile Data Consumption

The increasing reliance on mobile data services in India is a primary driver for the small cell-networks market. With mobile data consumption projected to rise by over 30% annually, the demand for enhanced network capacity becomes critical. Small cell networks provide a solution by enabling operators to offload traffic from macro cells, thereby improving user experience. This trend is particularly evident in urban areas where high population density leads to network congestion. As consumers demand faster and more reliable internet services, telecom operators are investing in small cell technology to meet these expectations. The small cell-networks market is thus positioned to benefit from this surge in data consumption, as it allows for more efficient use of spectrum and improved service delivery.

Rising Demand for Smart Devices

The proliferation of smart devices in India is significantly impacting the small cell-networks market. As more consumers adopt smartphones, tablets, and IoT devices, the demand for reliable and high-speed connectivity intensifies. This trend is evident in the increasing number of connected devices, which is projected to reach over 1 billion by 2025. Small cell networks play a vital role in accommodating this surge by providing localized coverage and offloading traffic from congested macro networks. The small cell-networks market is thus positioned to thrive as operators seek to enhance their networks to support the growing ecosystem of smart devices. This demand not only drives infrastructure investment but also encourages the development of innovative solutions tailored to meet the needs of a connected society.

Increased Investment in Telecommunications

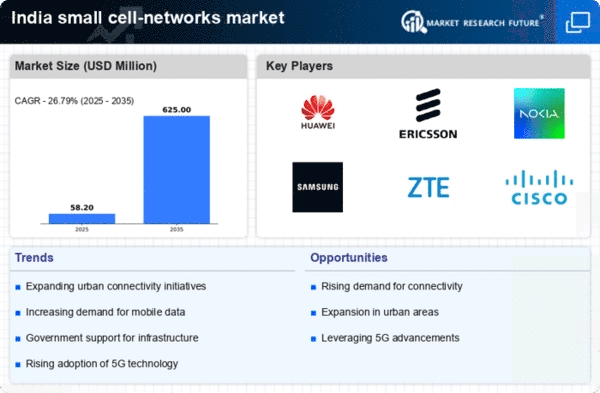

Investment in telecommunications infrastructure is a crucial driver for the small cell-networks market in India. The government and private sector are channeling substantial funds into expanding and modernizing network capabilities. Reports indicate that the telecommunications sector is expected to attract investments exceeding $100 billion over the next five years. This influx of capital is likely to facilitate the deployment of small cell networks, which are essential for enhancing coverage and capacity in urban environments. The small cell-networks market stands to gain from this trend, as operators look to upgrade their infrastructure to support growing data demands. Furthermore, the competitive landscape encourages innovation and efficiency, further driving the adoption of small cell technology.

Urbanization and Infrastructure Development

India's rapid urbanization is a significant factor influencing the small cell-networks market. With over 34% of the population currently residing in urban areas, the need for robust telecommunications infrastructure is paramount. Small cell networks are particularly effective in densely populated regions, where traditional macro cell towers may struggle to provide adequate coverage. The government has initiated various infrastructure projects aimed at enhancing connectivity, which further supports the deployment of small cells. As cities expand and the demand for high-speed internet grows, the small cell-networks market is likely to see increased investments and deployments. This urban-centric approach not only addresses coverage gaps but also aligns with the broader goals of digital inclusion and economic growth.

Technological Advancements in Network Solutions

The small cell-networks market is being propelled by continuous technological advancements in network solutions. Innovations such as 5G technology and network virtualization are enhancing the capabilities of small cells, making them more efficient and cost-effective. As telecom operators in India transition to 5G, the integration of small cells becomes essential for achieving the desired network performance. These advancements allow for improved data speeds and reduced latency, which are critical for applications such as IoT and smart devices. The small cell-networks market is thus experiencing a transformation, as operators seek to leverage these technologies to enhance service offerings and meet consumer demands. The potential for increased operational efficiency and reduced costs further incentivizes the adoption of small cell solutions.